1. SELECTING A REALTOR®

Our job is to assist you in finding the right home with the best possible terms, and to aid you through the entire process. We will explain the process of buying a home, and familiarize you with the various activities, documents, and procedures that you will experience throughout the transaction.

• 17+ years of full time real estate experience

• Expertise on neighborhoods and local markets

• Additional insights into listings that are not accessible online

• Proven negotiators with you every step of the way

• Knowledgeable partners through the closing and beyond

• Spanish Speaking ∙ better communication = amazing service

2. FINANCING

Most real estate professionals and mortgage lenders recommend pre-qualifying for a loan before selecting a home to purchase. This process will help you:

- Determine the price range you can afford.

- Understand the types of loans you qualify for.

- Determine what your monthly payment will be.

- Estimate the down payment and closing costs.

3. THE LOAN PROCESS

We will assist you in selecting a mortgage lender. Once you have made your decision, these are the steps of the process:

Application All pertinent documentation is obtained. Fees and down payments are discussed, and the borrower will receive a Good Faith Estimate (GFE) and a Truth-in-lending statement (TIL), itemizing the rates and associated costs for the loan. You will be asked to provide certain documents to your lender in order for your loan to be processed in a timely manner.

Loan Submission Once all the necessary documentation is in, your completed file is submitted to a lender for approval.

Loan Approval(Underwriting) Loan approval, or underwriting, generally takes 24 to 72 hours. All parties are notified of the approval and any loan conditions that must be received before the loan can close.

Closing Once all parties have signed the loan documents, they are returned to the lender. If all the forms have been properly executed, the lender sends the loan funds by wire transfer. At this point, the borrower finishes the loan process and actually completes the purchase of the home.

4. FINDING AND CHOOSING THE RIGHT HOME

Based on criteria your search criteria, we will help you find the perfect property. There are many factors to consider in selecting a property, including location, bedroom and bath count, schools and local amenities.

We will apply our extensive community knowledge and professional resources to research available properties, and show you the properties that best meet your needs. If you find a property that interests you through the internet or your own research, let us know so that we can arrange a showing.

As you view different properties, your criteria may change. Open and direct communication with us is a key element of a successful property search.

5. MAKING AN OFFER

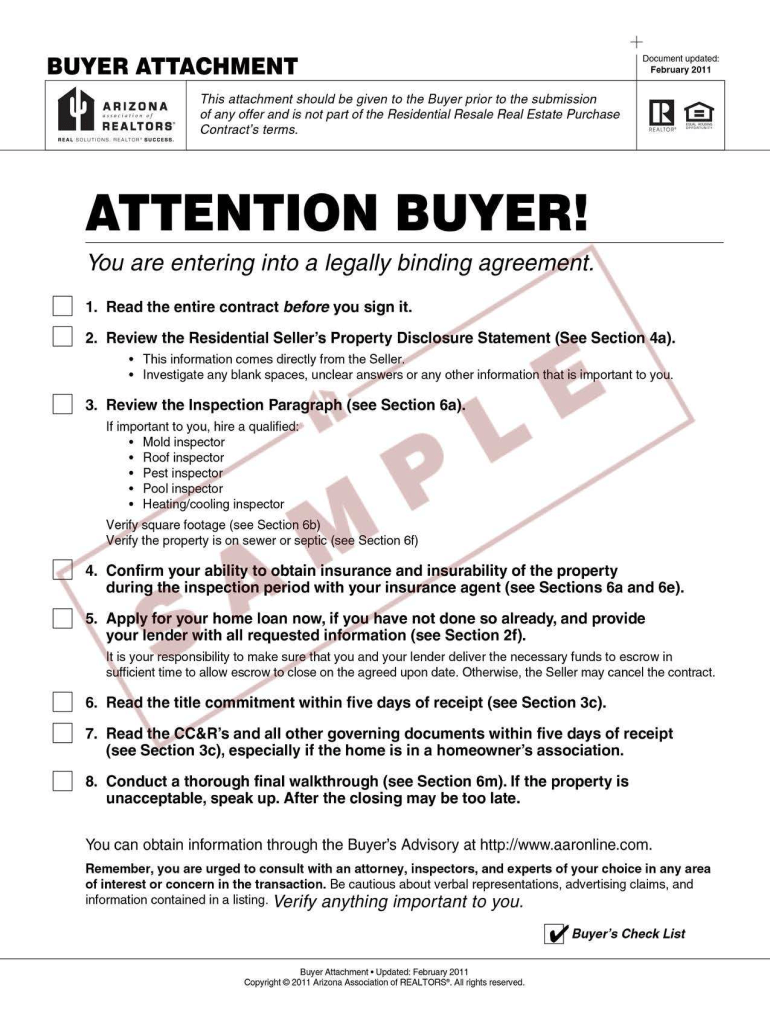

Once you have found the home that you wish to purchase, we will assist you with all the necessary research to help you structure an effective offer.

This is where our skills come into play. When an offer is made, the seller will have the option of accepting, rejecting or counter-offering. We will negotiate the best possible terms for you.

We will draft the purchase agreement, advising you of protective contingencies, customary practices, and local regulations. Home warranty, title and escrow arrangements will be detailed in the offer. Although we will give you advice and information, it is your decision as to the exact price and terms that you wish to offer.

6. MANAGING THE ESCROW

When the purchase agreement is accepted and signed by all parties, we will open escrow for you and your earnest money will be deposited. The escrow is a neutral third party that will receive, hold, and distribute all funds associated with your transaction.

7. CLOSING ESCROW AND MOVING IN!

When all of the conditions of the purchase agreement have been met, you will sign your loan documents and closing papers. You will deposit the balance of your down payment and closing costs to escrow, and your lender will deposit the balance of the purchase price. The deed will then be recorded at the County Recorder’s office and you will take ownership of your home.

We will provide you with valuable sources and helpful tips for planning and coordinating your move.